Investment

Bulletin

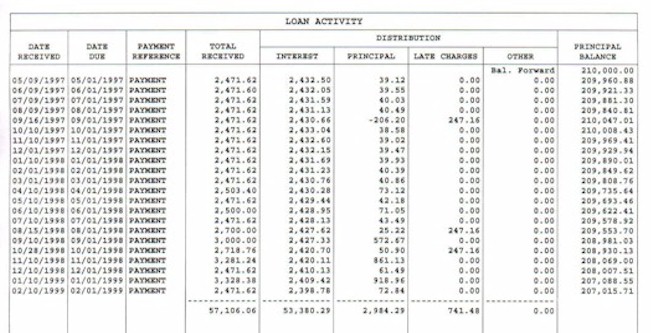

| Loan Number: 883 Loan Amount: $207,015.71 Type: First Trust Deed Yield: 12.0% |

For Instructions on How to Invest in this Loan

Terms of Investment . . . .

. . . . . . . . 60 months

Appraised Value as of August

13, 1996 . . . . .$430,000 |

Project: GATORAMP BUILDING Property address: 808 Bevins Street, Lakeport, CA 95433 Description: The

subject property improvements OPERATING STATEMENT INCOME EXPENSES |

|

BORROWERS |

||

| Name(s). . . . .

. . . . . . Individuals Net worth . . . . . . . . . . . .$532,400 His occupation . . . .Auto Repair Employer . . . . . . . . . . . . . . . .Self Employment income. . . . $10,132 Her occupation . . . . .Bookeeper Employer . . . . . . . . . . . . . . . . Self Employment income. . . . $10,291 Other income. . . . . . . . . . . $4,975 Percent ownership . . . . . 100.0% |

Name(s). . . . .

. . . . . . . . . . . . . . . Net worth . . . . . . . . . . . . . . . . . . His occupation. . . . . . . . . . . . . . Employer . . . . . . . . . . . . . . . . . . . Employment income . . . . . . . . . Her occupation. . . . . . . . . . . . . . Employer . . . . . . . . . . . . . . . . . . . Employment income. . . . . . . . . . Other income. . . . . . . . . . . . . . . . Percent ownership . . . . . . . . . . . |

Name(s). . . . .

. . . . . . . . . . . . . . . Net worth . . . . . . . . . . . . . . . . . . His occupation. . . . . . . . . . . . . . Employer . . . . . . . . . . . . . . . . . . . Employment income . . . . . . . . . Her occupation. . . . . . . . . . . . . . Employer . . . . . . . . . . . . . . . . . . . Employment income. . . . . . . . . . Other income. . . . . . . . . . . . . . . . Percent ownership . . . . . . . . . . . |

|

|

|

GATORAMP BUILDING

|

![]()

If

you would like to talk to our investment department, please contact John

Caldwell or Mike Thurman

at 916-338-3232 or 800-606-3232 between the hours of 8:30 a.m. and 5:00

p.m. PST Monday--Friday.

Please read our Audited Financial Statements of Blackburne & Brown, Inc.

Real

Estate Broker

California Department of Real

Estate -- License Number 829677

Copyright © 1999 Blackburne & Brown Mortgage Company, Inc. All rights reserved.